Operating margin meaning

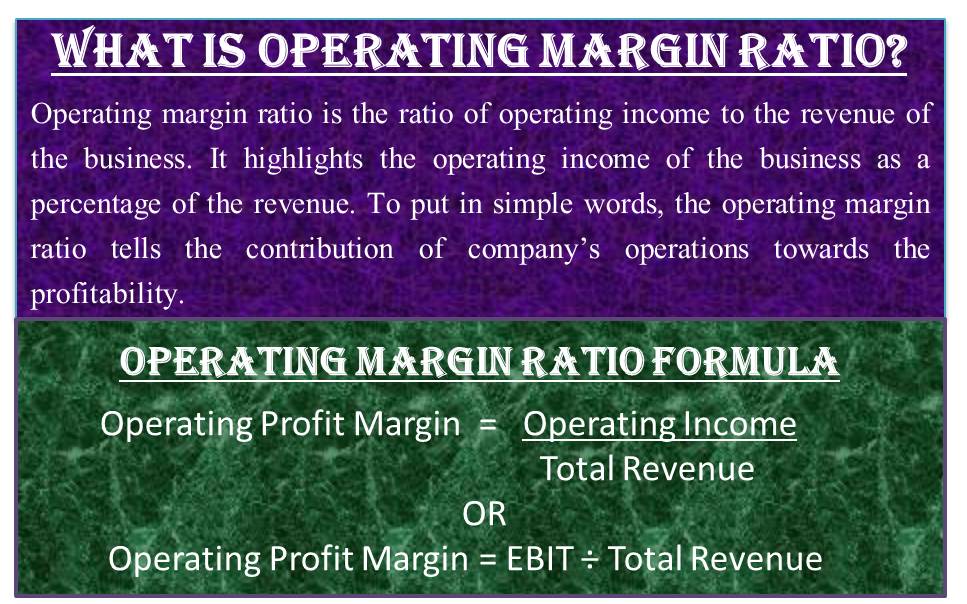

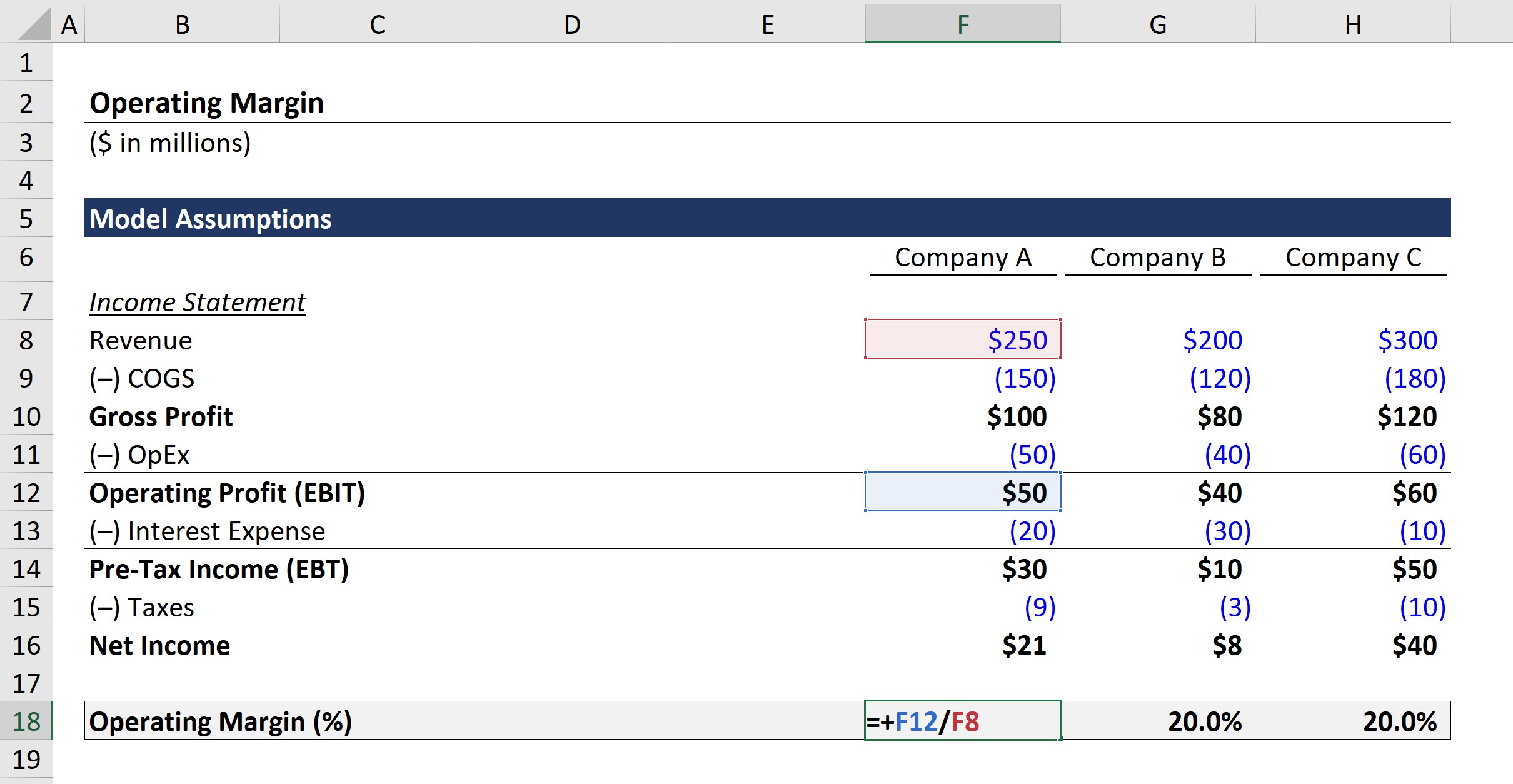

Operating Margin Operating IncomeTotal Revenue. This is an important metric because it indicates to investors the profitability of.

Operating Margin Formula And Calculator Excel Template

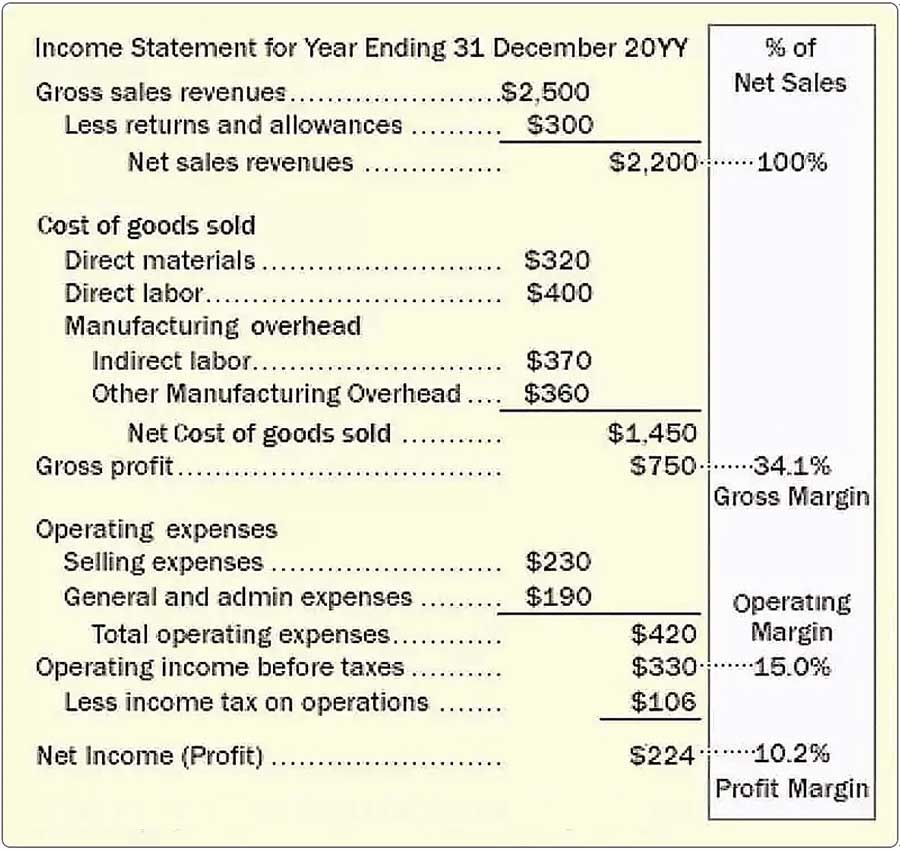

Operating margin operating earnings divided by revenue.

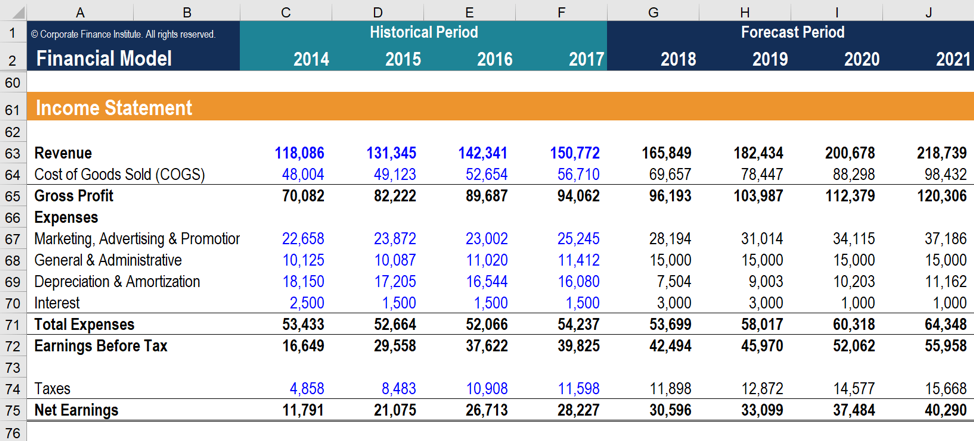

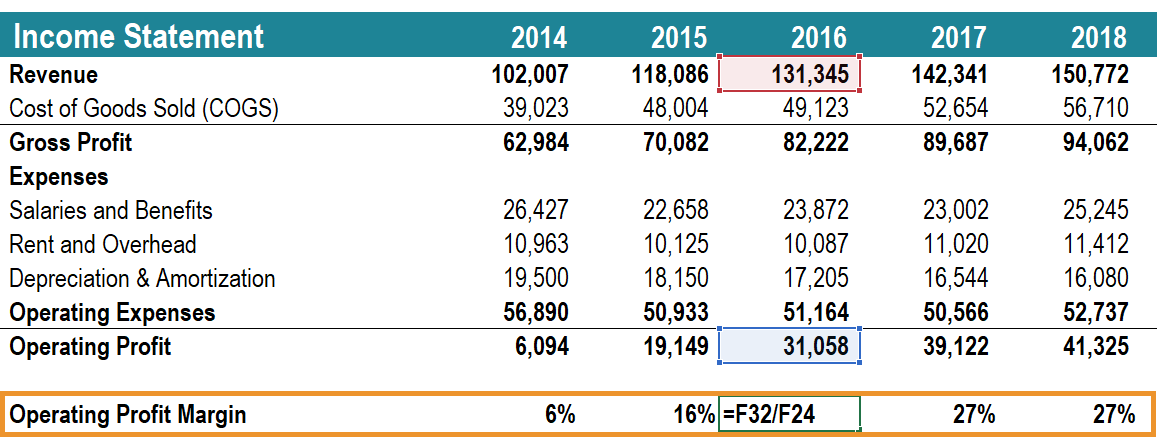

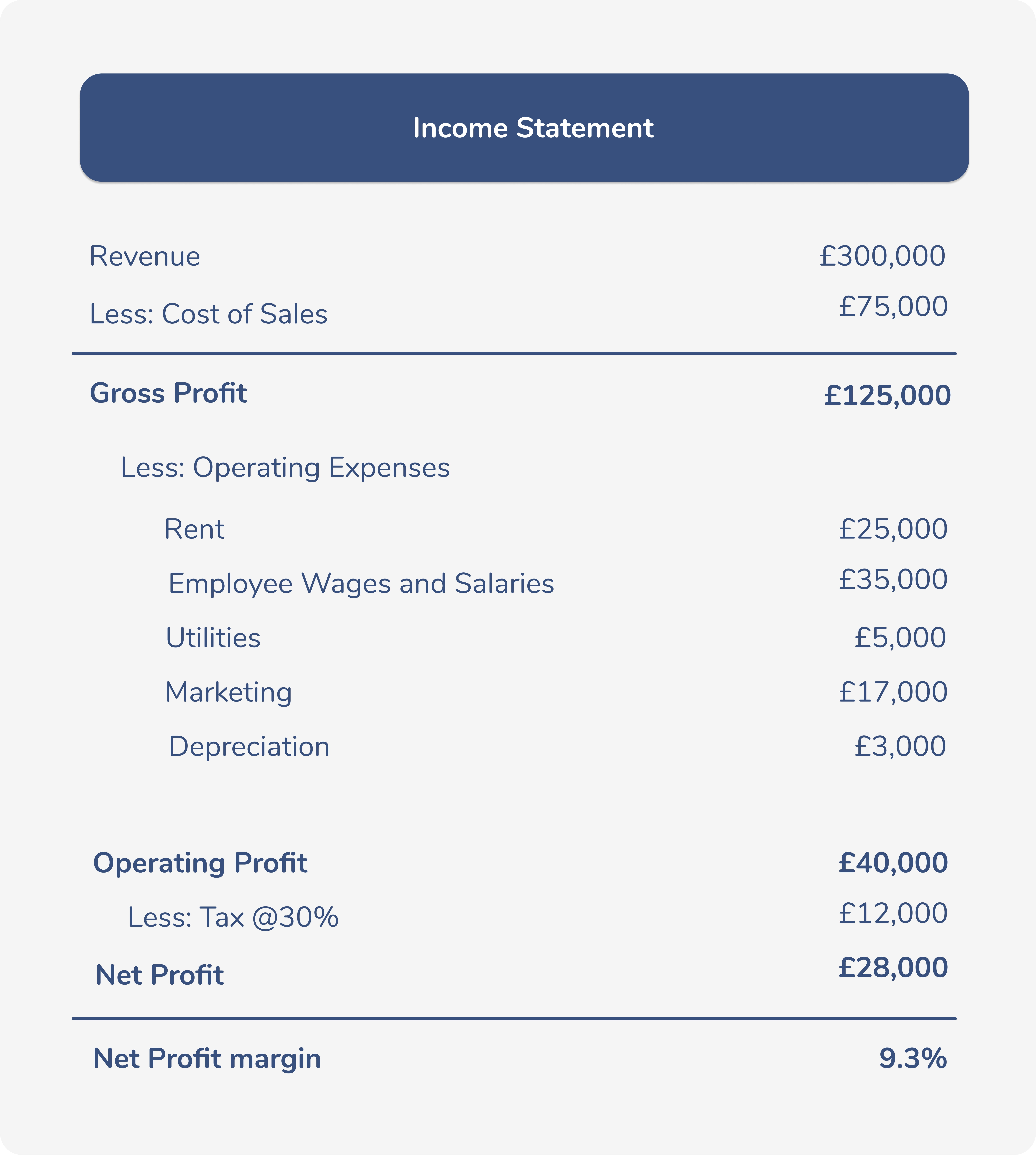

. The operating profit would be Gross profit Labour expenses General and Administration. It is an important indicator of efficiency and profitability. Example of an Operating Profit Margin calculation.

By definition earnings before interest and taxes EBIT exclude non. For example let us assume that the total revenue earned by company X in the year 2020 is 100 million. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales.

The relationship of gross profits to net sales in a business. Operating margin is the percentage of revenue that a company generates that can be used to pay the companys investors both equity investors and debt investors and the. Operating margins can be.

Now lets apply the formulas weve shown above. Operating margin is a more significant bottom-line number for investors than gross margin. After deducting the cost of goods sold and operating expenses the.

This ratio shows how much profit is earned for each dollar of sales. Now we will deduct the operating expenses from gross profit to determine the operating profit. Gross profit margin is a type of profit margin that measures the difference between sales revenue and the costs of goods sold COGS which includes direct product.

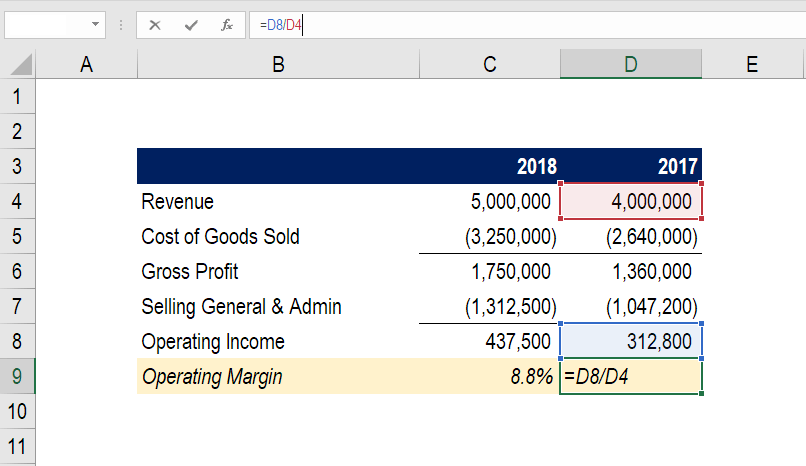

For example an operating margin of 8 means that each dollar earned in revenue brings 8 cents in profit. For example you own an apartment complex that earns 100000 per month in total revenue with 40000 per month in expenses. Operating Cash Flow Margin.

Operating margin is a profitability ratio that measures a companys operating efficiency after cost of goods sold and operating expenses have been deducted from revenue. Consider the following components of an Income Statement. Operating margin measures the percentage of revenue a company keeps as operating profit.

Comparisons between two companies operating margins with similar business. The operating margin line item on the income statement separates the operating and non-operating line items. In this formula operating earnings are equal to a companys earnings before taxes and interest.

Net sales are determined by subtracting returns and allowances from gross sales whereupon the cost of goods sold is then. Operating Profit Margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and. Operating margin measures the proportion of revenue left over after paying the variable costs of production.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is Operating Margin Ratio Significance Importance Example

How Do Operating Income And Revenue Differ

Operating Profit Margin Formula Meaning Example And Interpretation

Operating Profit Margin Formula Meaning Example And Interpretation

/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)

The Profitability Ratio And Company Evaluation

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Operating Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Definition How To Calculate It Tide Business

Operating Margin An Important Measure Of Profitability For A Business

Operating Profit Margin Learn To Calculate Operating Profit Margin

Gross Profit Margin Vs Net Profit Margin Formula

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Margins Measure Business Profitability And Reveal Leverage

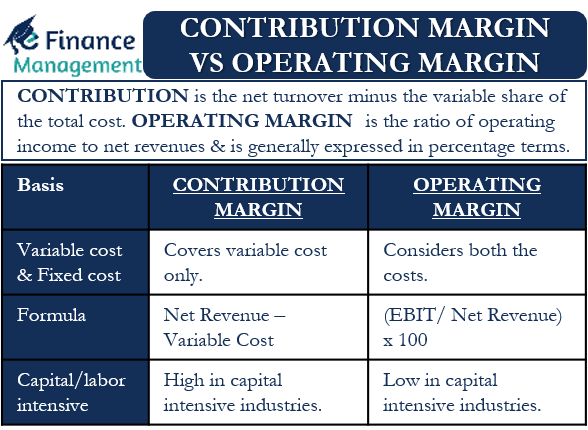

Contribution Margin And Operating Margin Meaning Differences Merits

Operating Profit Margin Definition Formula And Calculation Wise Formerly Transferwise

Operating Margin Formula And Calculator Excel Template